Budget. Just that one short word can induce so much stress and anxiety. College students have a common image of being broke and bad with money, but we know that isn’t the case. In fact, many young adults are actually highly intuitive with their finances and passionate about building a solid strategy early in life. The sooner you start planning, the better off you stand to earn and grow down the line. Post-grad life, and all the horrifying responsibilities of adulthood, won’t be able to get you down if you’ve got the right budget for your personality.

What does your personality have to do with a budget? A lot more than you may think. Budgeting isn’t just about putting some money away and not overdrawing your account each month. It’s a personalized financial strategy rooted in meaningful goals, both short and long-term, as well as different methods of saving, spending, and investing your hard-earned cash. Wondering how it all works?

Hardcore Saver

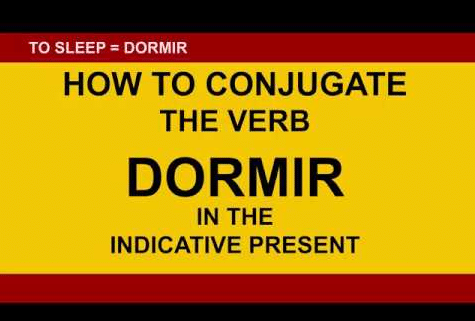

In some circles, you may even be called a scrooge. Don’t take it personally. Not everyone has the willpower it takes to put off spending, especially when online shopping makes instant gratification one tap away. If you love to save and are good at holding onto money, then your budget should be rooted in two things: organizing your savings and growing your wealth. By creating more dynamic savings goals, you’ll be able to adopt some flexibility into your savings that make them feel less stagnant or constrictive; the latter involves getting into investment.

Impulse Spender

You may be able to pay your bills and meet any financial obligations, but you can’t hold onto any excess money for a long period. You always promise to start saving later, but later never seems to come. You love going out, buying new things, or investing in experiences. While they may justify the one-off expense, they don’t leave you any better off in the grand scheme of things. You need a plan that gives you freedom and flexibility while creating structure. This means you should learn how to prioritize your spending as well as differentiate between initial costs and returns on investment.

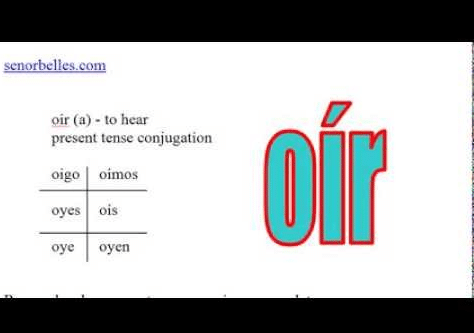

Anxious Avoider

You hate the idea of budgeting; it makes you queasy and you’d rather just spend and save however it works best for you at any given point in time. We get that budgeting can be stressful, especially if you find yourself coming up short or running low on funds. But budgeting is not only for rich people or those with a large surplus of money each month. On the contrary, you can gain greater security if you manage your finances more in-depth.

Type 1

Because you love to save, make sure that you are getting the most out of what you’re putting away. A high-yield savings account could be a great option, especially if you’re able to put away a decent figure each month. In college, your income is likely limited, but there are accounts designed specifically for students to look into.

You should also explore ways to save more on mandatory costs, like your subscriptions, food, and tuition. If you aren’t applying to scholarships now, do so ASAP. You can spare your future self thousands of dollars in student debt by getting free scholarships. This platform will help you locate eligible awards and apply in less than 30 minutes. As far as investments go, look into beginner stocks and possibly even life insurance. Getting whole life insurance in your 20s will give you the best deal on premiums and decades to amass a decent cash value.

Type 2

The first thing you need to do is make a list of your financial responsibilities each month. A simple Google Sheets or Excel spreadsheet can help. How much do you have to give away, without question, each month? Next, identify your long-term costs, namely student debt, credit cards, and ongoing subscription services. How much are you expected to spend in four months, a quarter, or a year?

Once you know how much you need to have, you can start to reassess how much you should really be spending. If you have a lot of free money to throw around, consider what you’re really getting for each purchase. Can you make a full list of everything you’ve bought in the last two months? Have they genuinely improved your life in some way? Separate wants vs. needs, and set a boundary for any unplanned purchases. If you don’t need it to survive, wait at least seven days before buying it. You likely won’t remember 90% of what you’re thinking you need by then.

Type 3

For those who get immense anxiety at the thought of budgeting, make things simple by installing an app. There are both free and paid options out there, and we suggest starting with the former to get started. Once you get into the flow of managing money and seeing data, it will be easier to identify future needs. Paid features often offer greater control options that may be daunting. Keep it simple and focus on an app that highlights your monthly income, spending, and savings.

Another good way to curb anxiety is to automate necessary expenses. You don’t have to worry about missing a payment, and you can even get a discount from some providers if you set up electronic payments. You should also prioritize automatic savings to help you build a safety net. It can bring a sense of relief and achievement each month as you check your account and notice more savings adding up.